Common Medicare Supplement Questions: The Top 10 List

Below is a list of the most commonly asked questions we are asked about Medicare supplements. By far, most people want to know which option covers everything, without ANY gaps. Known as the Cadillac of Medicare/Medicare Supplements, you want PLAN F. There is a small monthly cost but with PLAN F, it will cover wellness, hospice, foreign travel and much more.

Here is the top 10 list for the most common questions about Medicare and Medicare supplements:

How Do I Sign Up for Medicare?

If you are currently receiving Social Security, you will be automatically enrolled in Medicare Parts A and B when you turn 65. You will receive a “Welcome to Medicare” packet and a red, white and blue Medicare card 2-3 months prior to turning 65. No action is necessary to enroll in Medicare as it will start the 1st day of the month you turn 65.

If you are NOT receiving Social Security but you DO want to enroll in Medicare, you will need to proactively enroll in Medicare Part B (you’ll be automatically enrolled in Part A). To sign up for Part B, you can go to a local Social Security office or call them at 800.772.1213. Or, you can enroll for Medicare online at the Social Security web site.

How Much Does Medicare Cost?

There is no cost for Medicare Part A (hospital) if you have worked 40 quarters/10 years.

For Part B, there is a premium. For 2017, the standard Medicare Part B premium is $134/month which is typically taken from your Social Security check.

There are certain situations that could cause you to pay more or less premiums. These situations are largely dependent on your income as reported by the IRS from two years ago. This is called the Income-Related Monthly Adjust Amount (IRMAA). Medicare has more information about IRMAA here.

If you have been on Medicare for a few years, you may be “grandfathered” to a lower premium amount. That could be between $104 and $134, depending on what year you started Medicare and your specific situation.

Does Medicare Cover Preventive Care?

YES! Medicare covers a good amount of preventive care now. This article details specifics about Medicare’s coverage of preventive care.

Medicare covers a “Welcome to Medicare” physical within the first 12 months of going on Medicare. After that, it covers an annual wellness exam and many other screenings/tests on Medicare-established schedules. These include, but are not limited to, bone mass measurements, screenings for cardiovascular issues, breast cancer and colorectal cancer. Glaucoma tests, flu shots, lung cancer screenings, prostate cancer screenings, and many more are included.

What is the Difference in Medigap and Medicare Advantage?

These are the two very important, and distinct, options you have when you go on Medicare.

Medigap plans supplement Medicare, whereas Medicare Advantage plans take the place of Medicare. Medicare Advantage is a “privatized” version of Medicare.

Medicare Advantage plans have lower premiums in exchange for a lower level of coverage and more restrictions (i.e. networks, annual plan changes, pre-approvals, etc).

You have to be approved to get a Medigap plan if you are not in your initial open enrollment period or a valid “guaranteed issue” period. This makes your initial selection important, as you can be stuck in an Advantage plan, unable to qualify for a Medigap plan if you have pre-existing conditions.

Do I Have to Get a Part D (Rx coverage) Plan?

Many people get conflicting information about this issue. The short answer is “No”.

However, if you decide against a Part D plan, you will be subject to the Part D late enrollment penalty if/when you sign up for it at a later time. This penalty is 1% of the standard Part D premium per month that you did not have a plan. So, if you wait 5 years to sign up for a Part D plan, you’ll pay 60% more than someone else who didn’t wait.

Part D plans begin at $15-20/month in most markets. We recommend that you get this coverage when you are first eligible regardless of whether you “need” it at the time or not.

How Do I Decide Which Part D Plan to Get?

If you are not on any/many medications, you may want to base the Part D decision primarily on the plan premiums. So, if you are buying a Part D plan solely to avoid the Part D late enrollment penalty, you can base your decision on the cost of the plan and upgrade later if your needs or the plan changes.

If you are not on any/many medications, you may want to base the Part D decision primarily on the plan premiums. So, if you are buying a Part D plan solely to avoid the Part D late enrollment penalty, you can base your decision on the cost of the plan and upgrade later if your needs or the plan changes.

If you currently take some medications, it is crucial to compare the plans based on your specific medications. Co-pays can vary dramatically from one plan to another for the exact same medication. The Medicare.gov website has a Part D comparison tool that enables you to do this very easily by entering your zip code, medications and preferred pharmacy. We provide this comparison information for our existing clients or if you intend on using our service to take care of this coverage for you.

Which is the best Medigap Company or Plan?

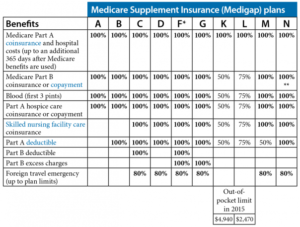

Medigap plans are Federally-standardized. The coverage with one company is exactly the same as coverage with another company for a similar plan.

For example: One Plan F is exactly the same as another Plan F. The only difference is premium and the insurance company. Therefore, the “best” is simply a function of price. Our experience will help you determine the best Medigap plan for you.

Which Doctors Take My Medicare Supplement Plan?

You can go to any doctor or hospital nationwide that accepts Medicare patients. There are no networks on Medicare Supplements (Medigap plans). If your doctor takes Medicare, he or she will also take your Medicare Supplement.

Do not confuse this with Medicare Advantage plans – many people call those plans Medicare Supplements and they are not. Those plans have networks and are either PPOs or HMOs.

Why Do I Have to Answer Medical Questions to Get a Medigap Plan?

The ACA does not apply to Medicare or Medigap plans. Since Medigap plans are supplemental in nature, they are not affected by the legislated reforms, meaning that pre-existing conditions are not automatically covered. Any time you change Medigap plans or enroll in a plan outside of your initial open enrollment window, you will have to qualify medically and answer health questions.

What is the Best Way To Enroll in a Medicare Supplement Plan?

Let our experience guide you and allow us to help you acquire the right coverage in the most efficient way.

Please contact Deborah and she can help you directly or connect you with one of our medicare partners. Deborah Bernstein can be reached at 561-988-8984 x2.