A big part of our practice is dedicated to helping women create retirement security. We discuss the challenges facing many single women face planning for retirement. A common concern shared by all women is how they will manage complex portfolios that require attention and time and is that necessary. The challenges of managing a complex portfolio of equities or bonds gets more difficult with age. We offer insight to men and women about just how difficult this process is at 80 or 90 years old. Once people come to learn about the benefits and the guarantees of income annuities, they begin to shift their risky equities to no-risk, guaranteed income contracts.

Similar Posts

How Much Life Insurance Should You Buy?

Term Insurance Rates Are Remarkably Low! How Much Life Insurance Should You Buy? From Who? It is important for consumers to have a good understanding of…

Term Life Insurance In Danger of Lapsing?

Is your term life insurance lapsing? Do you know when the conversion deadline in your term life insurance policy expires? One of the most critical…

Indexed Annuitiy: A $200 Billion Market

Should you have a portion of your retirement assets in an indexed annuity? There is a great deal of information about how to allocate retirement…

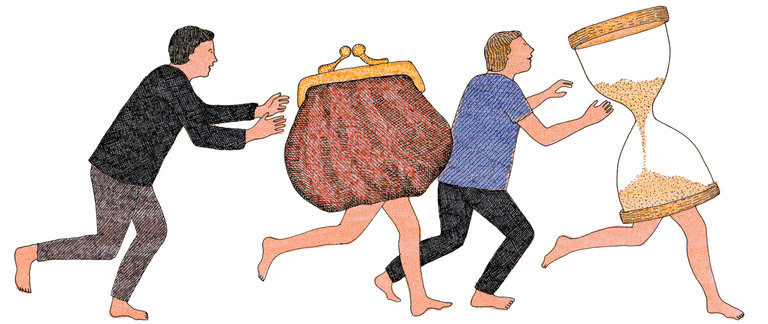

What Should You Choose: Time or Money?

An excellent article in The New York Times Sunday Review “But when it is a choice, the likelihood of choosing more time over more money…

Customized Insurance Policy Lowers Premiums As Much As 40%

NEW INSTALLMENT PAYOUT OPTION REDUCES ANNUAL LIFE INSURANCE PREMIUMS AS MUCH AS 40%! Life insurance buyers have a new and often better option to protect…

2016 Election and Your Retirement

The 2016 Elections are over, and now you should learn on how this will affect your retirement. Here are a few resources to help clarify…