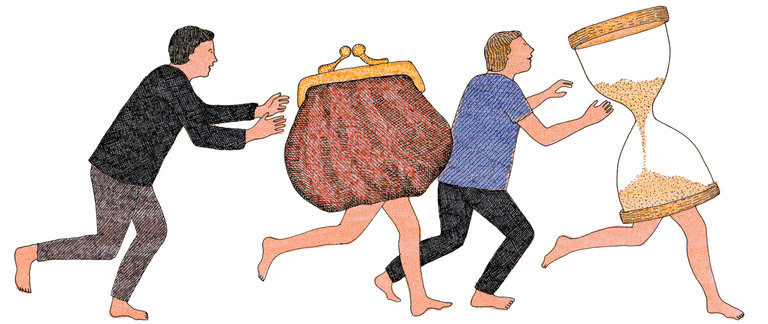

Should you have a portion of your retirement assets in an indexed annuity? There is a great deal of information about how to allocate retirement assets. A fixed indexed annuity offers upside with virtually no downside.

- If you want to create an income stream that is guaranteed for life, an indexed annuity may be the right tool.

- If you want to protect your principal and receive a guarantee that you will NEVER lose it, you may want to consider an indexed annuity.

- If you want market gains without market losses, a fixed indexed annuity will provide this “market insurance”.

- Only an insurance company can guarantee 100% principal protection and income for life.

Americans concerned about security in retirement are buying more than $200B of indexed annuities. Watch the video below to learn about the advantages of using a fixed indexed annuity versus variable annuities that continue falling out of favor for retirement planning.

Please contact me at 561-869-4500 or email me about a complementary consultation for indexed annuities and a review of your coverage.

You can visit us at www.facebook.com/lifecycleplanners

Also published on Medium.