Protect Your Retirement Assets.

We sell security, not securities.

We all wish we could make money when the markets are up and avoid losing it when markets are down. Conservative and aggressive investors alike – nobody wants losses!

As investors, we want the best of both worlds. When markets are up, we want to stay invested with minimal risk and we want to protect our gains. It is tempting to let it ride just a little longer and to stay fully invested, often against our own, best judgment. The problem is that markets take sudden turns for the worse. When they do, it can be paralyzing and difficult to minimize losses or to get out at the right time. It is difficult to consider changing course during these times and it is equally difficult to watch your assets plunging. With retirement assets, a sudden move down can be very costly. Waiting for the markets to cycle back up again is a completely different experience at age 67 than it is at 45. Time is not on your side. Depending on the severity of the drop and its duration will determine the extent of your losses.

The Good news.

The best time to consider alternatives is at the top of a market cycle. Instead of being too heavily invested in equities that offer no protection, a balance of income generating assets and equities will better protect your retirement assets. Income generating annuities are state-of-the-art, with indexes that participate in rising markets. Since they are not investments, there is no investment risk. Your principal and any growth is always guaranteed. While there is nothing inherently wrong with risky investments; they should not be the foundation of a retirement plan.

What I am asking you to consider are guaranteed income contracts or Fixed Indexed Annuities. Think of them as market indexed annuities because returns are partially based on how markets perform, without every being exposed to market losses.

“ROI is Reliability of Income in retirement, not Return on Investment. The goal of retirement security is achieved through a shift in focus from asset accumulation to income and asset protection.

Annuities are over 200 years old. THERE IS NO LOSS OF PRINCIPAL which is the PRIMARY ATTRACTION of an indexed annuity. During the 2008 Financial Crisis and the Covid bear market drop, none of our clients lost a dollar in their fixed indexed annuities. Today, there are millions of indexed annuities inside IRAs and other retirement plans. People want gains when the markets are rising and they want guaranteed income for life with downside risk.

The world’s leading economists all agree about the value of annuities in retirement. Consider what they say because they are unbiased and impartial. It makes no difference to them whether we invest our retirement assets in hedge funds or annuities. When Olivia Mitchell from Wharton (check out her incredible resume) says that annuities are key assets to own in retirement, she is saying so because she’s spent her entire career studying these issues. Nobody explains why mortality credits are the most valuable asset in annuities, better than Tom Hegna. When Professor Wade Pfau at The American College, or Roger Ibbotson from Yale write books about the advantages of annuities, their pro-annuity positions are credible because they don’t sell products.

Professor Pfau stresses that “investors typically fall into the ‘trap’ of depending on investment portfolios as the chief way to fund their retirement. Now, many of these folks in retirement find themselves needing a life raft…acquiring an annuity would have prevented such a dire scenario“, he argues.

HOW CAN YOU DO THIS?

These annuities are designed to modestly beat the performance of other fixed income products and typically, they do just that. There are also times when they do much better. These are important years that can really boost the overall performance of an annuity. For example, many of our clients earned as much as 14% from January, 2019 to January, 2020. Those were extraordinary returns because the market was experiencing extraordinary growth during that same period.

More Good News: The gains credited to an annuity contract can never be lost. The upside potential of an indexed annuity is determined by a contract, offering an additional level of security.

Personally, I do not like to hype the upside of market indexed annuities because their other advantages can be just as powerful.

Let no one with a financial interest in your assets dissuade you from making a financially sound and prudent decision, especially one that may be in your best interest. When you move money away from stock brokerage firms or wealth management firms, they’re losing significant, recurring revenue that is earned from your assets. I have no problem with fees charged by professionals. But, it should come as NO SURPRISE if they make you second guess a decision to move your assets away from their firm. To keep this simple, if you pay an annual fee of 1.5% on $1,000,000 of assets, that is $15,000 per year, or $150,000 of your money over 10 years.

When markets tumble and the assets in your account go down, so too does the revenue for the investment firm and the investment manager that is managing your money. Can you trust the advice of an advisor who loses annual income if you liquidate or move your account? Is that structure in your best interest? Most investors are not aware of these potential conflicts and many are surprised when they finally understand them.

Who doesn’t want more guaranteed, lifetime income? These annuities pay you for as long as you live AND guarantee the principal – forever. If the market drops 30%, you lose nothing. If you want certainty, predictable outcomes and no anxiety over your retirement security, this is for you.

“You pay no commission from your annuity assets. Instead of paying “forever fees” in managed accounts, fees that are directly reducing your retirement fund each year, there are no annual annuity fees*. The one-time commission is paid from the assets of the insurance company, NEVER FROM YOUR ASSETS! The interest calculations, participation rates and the contract terms are regulated by the Department of Insurance in your state.”

*Some people choose riders that may have annual, disclosed fees.

Guaranteed annuities are ideal for those of us who cannot stomach market volatility or wondering when the next crash will begin. Many people cannot tolerate watching their retirement assets evaporate during these market events. Hearing an advisor tell you “not to panic” or “it always comes back, be patient”, doesn’t help. That’s never easy to hear. In, or near retirement, you must be aware of a risk called “sequence of returns risk”. If markets are down near the beginning of your retirement, down years can be far more damaging. If you are drawing money from your retirement assets, down years can be more damaging.

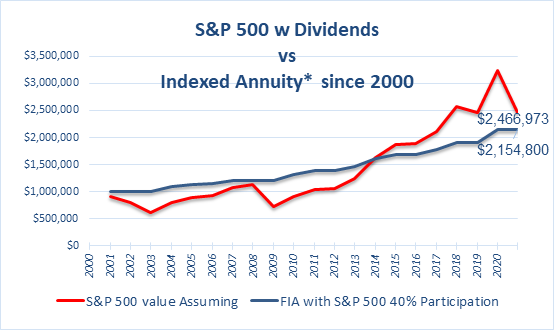

From 2000 to 2020, there have been three major bear markets and if you owned an indexed annuity, you avoided all three. That’s “peace of mind” – not a dollar lost over 20 years. Market indexed annuities are only available from major insurance companies because only these insurance companies are financially strong enough to provide the guarantees. They prove their financial strength to regulators and rating agencies each year.

The numbers say it all. In the chart below, the market-indexed annuity has performed nearly as well as the S&P 500 total return index (including dividends). WITH NO RISK!

Are annuities safe? If you are a conservative to moderate investor, why not let a market-indexed annuity take some of the most important guesswork out of your retirement planning? When the indexes are up, you can make money. If markets crash or if volatility takes over, you will never lose money. Keeping this simple, if you had put $500,000 in an indexed annuity in January or February of 2020, you still have $500,000 of principal today, plus possible gains. Your principal is always intact — always at the highest level it reached, which is called the high water mark.

You want the best of all possible worlds.

How Does This Work? Since the insurance company guarantees the principal, they share in some of the upside, when the markets are up.

“Don’t compare annuities to what might have been if interest rates had been higher, compare them to what is possible and available now. Now we are stuck with low rates. Trying to wait for rates to increase is going to eat away at your assets in the meantime, and there is nothing you can really gain from the effort. Low interest rates strengthen, not weaken, the case for purchasing a single premium immediate annuity.” Wade Pfau

Ken Fisher hates annuities. Why do some financial “experts” criticize annuities? Everytime a Ken Fisher client liquidates and moves money to an insurance company for the purchase of an annuity, Ken Fisher’s firm loses annual recurring revenue. Maybe this is why Ken Fisher hates annuities?

Which Is The Best Indexed Annuity?

There are thousands of annuities in the market. It is our job to know them and to know which one suits you best. To do that, we listen to what you expect in order to meet your goals and objectives. Some contracts are too expensive and some carry hidden fees and charges. You want to make sure to buy the right indexed annuity from an experienced professional who only represents insurance companies with high ratings.

Ready to start protecting your retirement assets and never lose money in the market again?

Contact us and allow us to answer all your questions? You have nothing to lose by taking a complimentary phone call. Time does matter. A low interest rate environment forces insurance companies to lower the rates for new clients. Safety is what drives their investment decisions and in order to properly respond to lower interest rates, they will change their offers accordingly.

Start the ball rolling and call us or fill out the simple contact form on this page or any page of the this site. We can be reached at 561-771-4647

Also published on Medium.