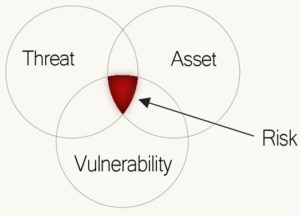

The right financial consultants can offer guidance about retirement, insurance, asset protection and guaranteed income strategies. These are the keys to creating and protecting retirement assets:

Threats to consider:

Insufficient Lifetime Income: The fact is that too many people have insufficient amounts of lifetime income. Financial consultants say the concept of liquidity in retirement is often misunderstood. The need for liquidity is different than when we are working and accumulating assets. The need for guaranteed income for life takes on new importance. There is comfortable balance of both and that is different for each one of us.

Longevity Risk: To mitigate the risk of living too long, we should increase the amounts of guaranteed, lifetime income.

Inflation: With interest rates at historic lows, inflation could be a retirement threat if rates move up quickly. Like un-managed high blood pressure, inflation causes unnoticed damage. Inflation is threatening due to our limited options to replenish principle.

Incorrect Asset Allocation: Proper asset allocation is important too when protecting retirement assets. Financial consultants work with their clients to determine the proper allocation strategies.

Rising Medical Costs: This is the retirement threat capable of immediate damage to a nest egg.

Loss of Spouse & Cognitive Issues– Both married and single retirees will likely deal with the issue of cognitive decline in retirement. For married couples, the loss of a spouse can be a trigger. This has proven to be a significant retirement threat, especially when one spouse assumes primary responsibility for investments. To mitigate the impact of cognitive decline, leading economists and retirement scholars agree about the great value of lifetime income.

Investment Scams: Be careful of “too good to be true” investments. I have very good radar for scams. Feel free to contact me for an opinion.

Fees: Fees and other charges are similar to taxes levied against your investments. They are disclosed, easy to measure and they add up.

Bad Advice: You know it when you see it. I meet with people in or near retirement every day whose number one objective is “no losses”. Yet, they’re retirement assets are invested in stocks and bonds. It never hurts to get another opinion and having a team of professionals with different disciplines is good prevention. Just make sure one of them is a retirement income specialist.

Market Losses: Of all the threats to retirement assets, market losses may be the most damaging. Because we don’t have time to replenish losses with income, we can’t overcome them. A fixed indexed annuity provides upside potential while never taking losses.

The key to security in retirement is making sure to avoid these threats. With the right strategies in place and by working with financial consultants, you can minimize most nest egg risks to gain that peace of mind you may not be currently enjoying.

Please call me at 561-771-4647 or email me about a complimentary consultation.