https://ted-bernstein-insurance.blogspot.com/2019/01/estate-tax-and-life-insurance.html

Visit my blog for insight and commentary about changes that may affect your planning decisions. The day after this post, Senator Sanders released his proposed bill to increase the federal estate tax.

The Sanders proposal calls for your estate to pay a 70% tax on assets exceeding $3M per person. For a married couple, assets over $6M – $7M will be taxed. Our recommendation is to plan as if the tax is 50% over $6M of assets.

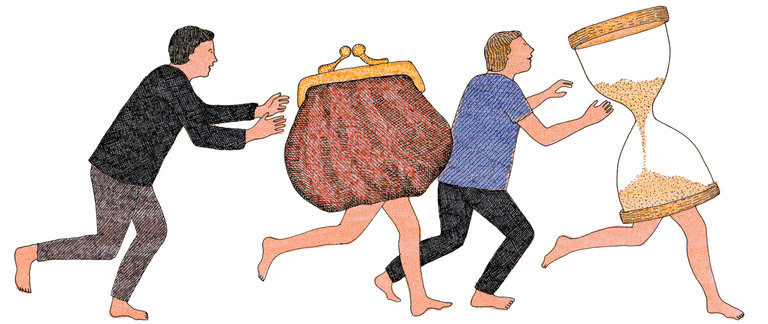

Although you may have recently been told that the 40% estate tax would not increase and the tax free credit would never drop from $11,000,000, per person, lawmakers are at it again. To plan properly, it is helpful to use levels that reasonably represent both taxes over the past 50 years. This will provide sufficient liquidity at death to help pay the tax. Otherwise, your estate will shrink by as much as the net tax amount.

For example, if we assume a $12,000,000 estate and a 50% estate tax for assets over $6,000,000 per couple, the tax calculation would be $6M X 50% = $3,000,000. To pass the full $12,000,000 to your heirs without any dilution, it might be wise to own $3,000,000 of permanent life insurance. The cost is minimal compared to the tax savings.

If it turns out there is no tax at the time of death, the life insurance always proves to be welcome liquidity for your heirs. This liquidity is an immediate infusion of tax free money with benefits on many levels. The leverage of permanent life insurance for this purpose is undeniable.

Please contact Ted Bernstein if you are concerned about the estate tax increasing. Let’s discuss your options and the planning strategies to mitigate the hit to your estate.