Why do high net worth people borrow to purchase life insurance?

Premium financing relies on the concept of interest rate arbitrage. A loan enables life insurance owners to keep their money working for them and earning a higher rate of return than the interest rate charged for the loan. Instead of paying life insurance premiums with their own capital, a low cost loan is advantageous. This rate arbitrage must be favorable and appreciated for a successful premium financing arrangement to be suitable and make sense for the borrower.

The Advantages of Premium Financing are:

- Low cost method to fund permanent life insurance while offering great flexibility in the future.

- Using well managed leverage to drive down out of pocket costs.

- Using life insurance to offset estate taxes.

- Using low cost loans to fund permanent life insurance with the goal being of having fully funded policies in the later years.

- To minimize out of pocket costs in early years until the anticipated exit strategies can pay off the loan.

Successful premium financing is understanding the risks and managing expectations. Working together with insurance companies and lenders ensures successful outcomes. People borrow money to pay for life insurance because they can borrow the annual premiums at a lower rate than what they are earning on their money. This historically reliable arbitrage between loan interest rates and a borrower’s ROI must be present for this to make sense. Later, we will explore this important arbitrage in more detail.

Premium Financing gives families with illiquid estates the ability to acquire large amounts of needed liquidity at death. By only paying annual interest on the loan, the out of pocket cost is less than paying properly funded permanent policies. Many estate planning attorneys find this financing strategy helpful to accomplish their wealth transfer objectives.

With short term interest rates near zero percent, life insurance premium financing gets strong consideration among high net worth life insurance buyers. Proceeds from life insurance provides the much needed liquidity that complements succession planning and wealth transfer planning strategies. Financing jumbo life insurance policies is often appealing to HNW people and their advisors because the arbitrage DOES EXIST between actual borrowing cost and the client’s overall ROI. If we look back 50 years, we see that interest rates are lower than insurance company crediting rates, with almost no exceptions. This correlation is the foundation of successful premium financing.

I have arranged financing for more than 500 families over the course of my career. As a result, I bring valuable expertise and experience that benefits consumers, their advisors, lenders and life insurance companies. For example, it is true that low interest rates are beneficial, if nothing more than causing a lower out of pocket cost. But, financing a life insurance policy should make sense whether interest rates are 3%, 6% or 9%. When borrowing costs increase, the values inside the life insurance policy should also be increasing. That can also lead to less collateral being needed for the loan and less premiums to fund the policy.

The borrowing rate is only one part of the premium finance story. Historically, insurance companies pay higher interest on policy cash values than borrowers pay for interest on loans. This is the other important rate arbitrage that should exist in properly structured premium finance arrangements.

Premium Financing Done Right.

Not free life insurance.

If premium financing is not “free life insurance”, then what is the true cost of financing a life insurance policy? It is the annual interest expense; that is the true out of pocket “cost” of a premium finance loan. When the loan is paid off, either during lifetime or upon death, that too is part of the cost.

With rates near 0%, premium financing is a strategy that deserves strong consideration for high net worth individuals, families and business owners who need permanent life insurance coverage. Compared to paying the annual premiums out of pocket, there are advantages to using a competitively priced loan to pay the premiums.

A properly structured premium finance arrangement is best suited for people who need and want coverage for life. The cost to borrow the annual premiums should be at least 3% lower than the ROI on their other assets. This creates another arbitrage that justifies premium financing. For example, if the loan interest rate is 4%, then the borrower’s ROI on other assets should be 7% or greater. If it is not, then it may not make sense to finance life insurance.

Premium Financing Considerations:

Each premium finance loan is unique and should be stress tested using conservative assumptions. We recommend working with experienced insurance professionals, advisors and experienced lenders who are familiar with this asset class.

The majority of the collateral for premium finance loans is typically the cash value within the policy. The reason lenders are willing to make premium finance loans at low interest rates is because cash value is considered to be as creditworthy as cash. Currently, premium finance loans are less than 3%. While interest rates are at historic lows, it can be wise to consider locking in a fixed rate.

Exit Strategy and The Loan Payoff.

There must be a sensible exit strategy to pay off the loan. One option is to use cash value from the policy. Another is to use assets already in the trust, such as inheritance monies, liquidity events from sales, etc. When the cash value of the policy is used to pay off the debt, make sure the policy is properly funded to remain inforce for life, after the cash value has been withdrawn or borrowed from the policy.

Can Real estate be used as collateral for premium finance loans?

Lenders typically do not like lending against real estate for these loans because the collateral is not easily available. However, there are some lenders that do work with existing clients to use real estate to support these loans. This tends to complicate something that is already complex. Customers with strong relationships have been known to receive loans from their existing bank.

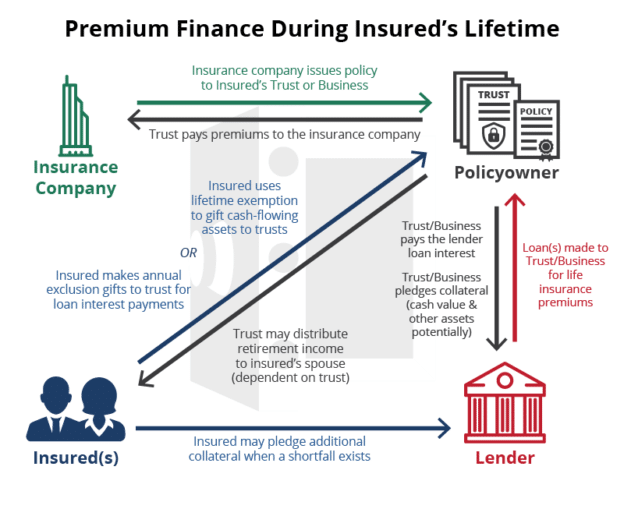

Premium Financing and Estate Planning.

A premium financing arrangement can be beneficial to your overall estate plan. The life insurance policy is typically owned in a trust without gift tax or estate tax consequence. It is not uncommon for $25,000,000+ life insurance policies to be financed and owned in trusts that may be exempt from gift or estate taxation.

Premium Financing Is Best Suited For:

- Clients who need jumbo amounts of permanent death benefit.

2. Clients who understand leverage & complex financial transactions, or

3. Clients using life insurance to offset estate taxes.

Business owners interested in succession planning and key-person protection may also be good candidates for premium finance arrangements:

Top 7 Premium Finance Considerations:

- Lenders and insurance companies require that these loans are collateralized. The policy’s cash value is typically the majority of the collateral. In the early years, there is typically a small gap which the policy owner is required to satisfy.

- The borrowing cost and the policy crediting rates have long been favorably correlated for these types of structures. They historically move in the same direction with the insurance policy crediting rates and dividend scales being higher than the borrowing costs.

- Assuming you feel this strong correlation will continue in the future, financing may be right for you.

- A positive rate arbitrage is created when policy crediting rates are greater than loan costs and a cushion is created that can be used when interest rates turn volatile or increase rapidly.

- When interest rates rise quickly, there may be temporary rate compression or even rate inversion. Either scenario could increase the annual interest expense until rates stabilize.

- The cash value of the life insurance policy ultimately represents 100% of the required collateral for the loan. Gap collateral must be pledged until the cash value is 100% of loan value, typically in less than 10 years.

- Properly structured, no personal guarantees are necessary.

Premium Finance Risks:

– Decreasing policy interest rates and policy performance risk.

– Increasing borrowing costs or inability to refinance.

– Policy lapse risk.

– Collateral call risk.

– Income tax risk.

STOLI RISK: Many premium finance structures have been created or used to take advantage of consumers and insurance companies by purchasing policies owned by strangers. They do this for the sole purpose of re-selling or using them for an illegal profit. We will not participate in STOLI arrangements and we urge people to avoid using life insurance for anything other than long term death benefit. Stranger Owned Life Insurance (STOLI) is not legitimate premium financing and should be avoided. Before proceeding with any premium financing arrangement, you want to fully understand the risks mentioned here and the exit strategies.

Inforce Life Insurance Policy Premium Financing:

- Policy is the only collateral for the full loan balance; no PG.

- Our capital source is a New York lender experienced in this asset class.

- 7-year loan maximum.

- Fees and interest are financed as part of the loan. Little or no out of pocket expense.

- Competitive interest rate.

- Life expectancies: 12 years or Less. Sweet spot is 9 years or less.

- Insureds: 70 and over.

- Individual Policies: $3-99m face.

- Portfolios: $35-500m face.

- Issued Preferred or Standard.

- Term sheets: Please allow turnaround time of 3-4 working days.

- International loans not an issue.

In addition to securing coverage and arranging for the right lenders for each loan, Ted is often hired as an impartial consultant to help life insurance buyers determine which is the best financing solution. These cases often involve jumbo insurance amounts. Working with an experienced consultant on your side that is not selling product can prove to be very valuable.

You can Email Ted or contact him directly at 561-869-4500.